Ways to Ensure a Tax-Smart Retirement

For many people, creating a financially secure retirement means years of disciplined saving and meticulous financial planning. Amid visions of leisurely days and newfound freedom, however, it’s easy to underestimate the looming reality of taxes in retirement. To make the most of your accumulated wealth, tax planning should continue long after you stop working.

“The tax implications that accompany retirement decisions can significantly impact a person’s overall financial landscape,” says Jennifer Wertheim, director of tax planning at CAPTRUST. “That’s why tax planning is such an important part of financial planning overall. It’s a way to safeguard your hard-earned assets and stretch your savings.”

“Retirement tax planning relies on four pillars,” says Elisabeth Jacobson, a CAPTRUST financial advisor in Lone Tree, Colorado. “Know how your assets will be taxed. Develop a strategy for how you’ll withdraw money. Avoid things that are going to put you in a higher tax bracket. And review your tax situation whenever life changes.”

Jacobson says she has seen many cases where new clients could have benefited from earlier planning for retirement taxes. “There are so many people who are good at saving and investing but aren’t aware of how their accumulated assets will be taxed when they are sold or withdrawn,” she says.

For instance, Jacobson says she once met with a couple who had already started taking required minimum distributions (RMDs) from their retirement accounts. RMDs are minimum amounts that must be withdrawn annually from individual retirement accounts (IRAs) and qualified retirement plans, like 401(k) or 403(b) accounts. Your birth year determines when you must start taking RMDs. Generally, they are required once you reach your early 70s.

“These clients had done a great job saving money, but they’d put all their savings into a taxable IRA,” says Jacobson. “That meant every single dollar they had was going to be taxed. And their RMDs were huge, so every time they withdrew money, they were raising their marginal tax bracket—and their tax bill—even further.” Incorporating projected taxes into your financial plan can help avoid mistakes like this.

“It’s impossible to predict what tax rates will be in a decade or more,” says Philip D’Unger, a manager on CAPTRUST’s wealth planning team. “And regardless, these rates are likely to change throughout your retirement years, which may be a long time considering life expectancy today.”

According to the MIT AgeLab, the average American can expect to live roughly 8,000 days—more than 20 years—in retirement, assuming they retire at age 65. “The goal is to be financially resilient, whether you live to 75 or 105,” says D’Unger.

Balance What Is Taxable

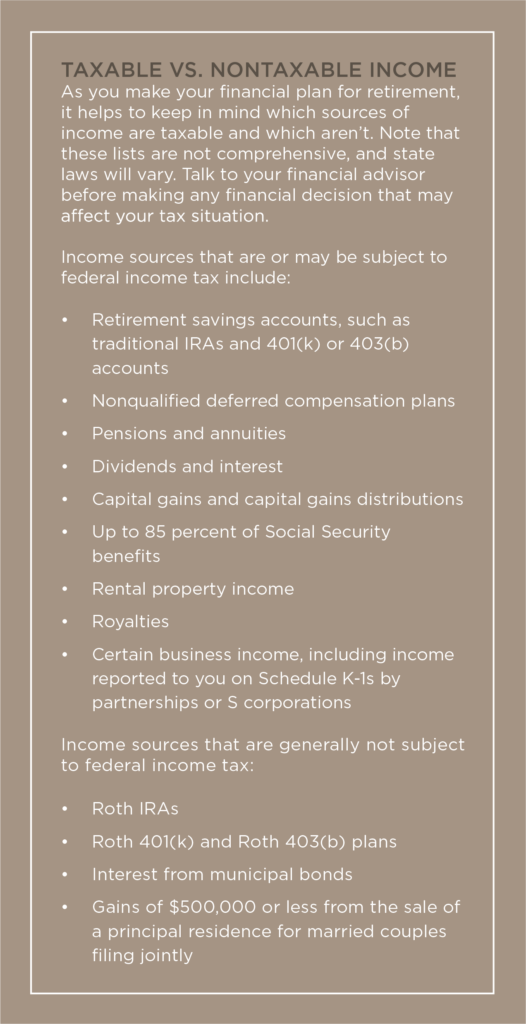

“It’s important to know all your possible sources of retirement income and how each one will be taxed,” says Jacobson. To start, make a list of your assets. Label which ones are taxable and which ones aren’t. If you aren’t sure about a particular asset, talk to your financial advisor. “Then, you can develop a thoughtful strategy to make sure you have the funds you need while also minimizing tax consequences.”

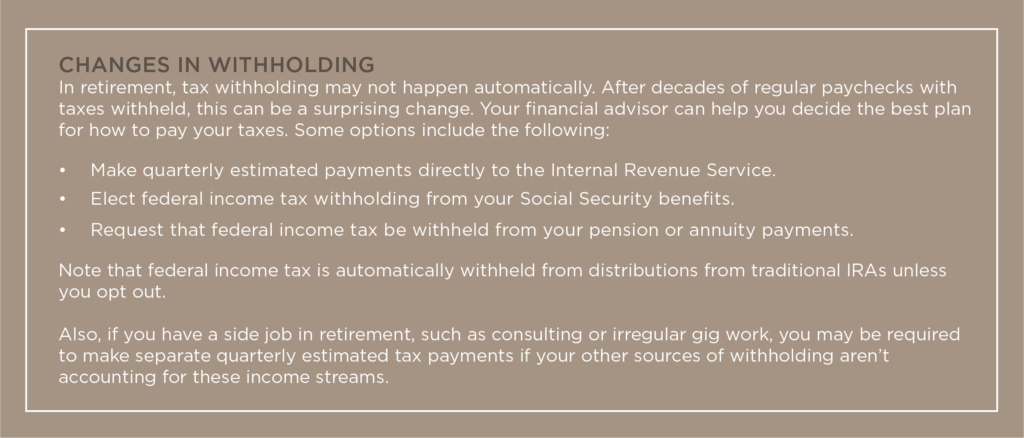

Some assets, such as Roth accounts, will be tax-free. Others, like pensions, will be fully taxable. You may see a third set of assets labeled as tax-deferred. This includes traditional IRAs and 401(k) plans. You don’t pay taxes on dollars in these accounts until you withdraw them.

“Ideally, you will have some balance of taxable and nontaxable assets from which to draw your retirement income,” says D’Unger. If your assets are out of balance, or you aren’t sure, talk to your financial advisor about rebalancing.

“As financial advisors, we talk a lot about diversification of assets, but having diverse accounts is also important,” says Jacobson. “With a balance of taxable and nontaxable assets, you give yourself more options, more flexibility. Once we see the full picture of where a person’s assets are being held, we can make sure they have a portfolio that will help them cover their expenses while managing tax implications.”

“For instance, you may have built up substantial amounts of money in the taxable and tax-deferred buckets, but not enough in the tax-free bucket,” says D’Unger. “Rebalancing can help you minimize and prepare for future tax consequences. And it can help you spread your tax consequences across multiple years so that your tax bill is more predictable.”

Make a Withdrawal Plan

“Having a financial plan that includes estimated taxes in retirement can help you avoid unwanted surprises,” says D’Unger. It can also help estimate what your spending may look like as you age.

Jacobson says people tend to spend more money in the first few years of retirement than they spend later. “Those early years can be a sweet spot for tax planning,” she says. “You don’t need to have everything figured out before you retire. But it’s a good idea to sit down in those first few years and figure out the big pieces of your new financial plan.”

For instance, Jacobson says she helps clients understand when to start taking Social Security benefits, when to sign up for Medicare, and when they’ll be required to take RMDs. “RMDs are a big piece we manage around,” she says.

“Up to 85 percent of Social Security benefits may be taxed, and RMDs are taxed at the ordinary income tax rates,” says Wertheim. “Deferring your distributions as long as you can makes sense from a tax perspective, but how long you can defer will depend on your retirement income needs.”

Capital gains are another factor to consider. If you sell a capital asset, you’ll need to pay capital gains taxes on the profits. Capital assets include stocks, bonds, real estate, coin collections, jewelry, and digital assets like cryptocurrencies.

Long-term capital gains tax rates are set at 0, 15, or 20 percent and apply to any investment owned for more than one year. Short-term rates are determined by a taxpayer’s ordinary income tax bracket and apply to assets owned for less than a year. This means long-term rates will be lower than short-term ones.

“There are multiple tax strategies that can help you take advantage of lower capital gains tax rates,” says Wertheim. “But mostly, you want to make sure you are being strategic about when you sell your capital assets so that your profits from the sale don’t unintentionally bump you into a higher tax bracket for the year.”

Capital gains can also increase Medicare premiums. “If you have a higher income year—for instance, because you’re selling real estate or some other large asset—pay attention to your Medicare premiums,” she says. “The Medicare system may automatically assume this new, higher number is now your regular yearly income.”

Wertheim recommends people pay attention to state tax rules as well. “There may be nuances at the state level that also allow for specific tax planning,” she says. “In particular, it’s important to understand how retirement income is taxed in your state before finalizing your financial plan.”

For example, Jacobson says, “Retirees can deduct between $20,000 and $24,000 in retirement income from state taxes in Colorado, depending on their age.” This means income from Social Security and pension plans may be mostly or entirely state-tax-free for many Colorado residents.

Give Strategically

Once you start taking RMDs, you may find yourself in a higher tax bracket. One way to minimize the tax consequences of a higher income is through a qualified charitable distribution (QCD). A QCD is a tax-free donation directly from your IRA to a qualified charity. Although there’s no tax deduction for these donations, making a QCD can reduce your RMD in a given year without boosting your overall income.

“In 2024, anyone over 70 1/2 can contribute up to $105,000 directly from their IRA to a qualified charity,” says Jacobson. “This can help you meet your charitable goals and simultaneously meet your annual RMD. Plus, you don’t get taxed on it! It’s a triple win.”

“Giving to a 529 education fund is another way to satisfy a gifting goal, and you’ll typically get a state tax deduction,” says Jacobson. “We used to advise against this strategy because it sometimes affected financial aid eligibility for the recipient, but the rules have recently changed. Now, it makes more sense for more people.”

Another option to mitigate your tax bill is to use a donor-advised fund (DAF). This is a charitable investment account that lets you donate cash, securities, or other assets to qualified public charities.

“If you contribute to a donor-advised fund at about the time you retire, you can claim a federal income tax deduction for the year in which you make the donation,” says D’Unger. “Later in retirement, if you sell a capital asset, a DAF can also help you avoid the capital gains tax that would be due on the sale.”

“Taxes are inevitable,” says Jacobson. “But they can be managed. Having a retirement income plan that accounts for taxes can make your tax bill more predictable. It can give you confidence to spend what you’ve worked so hard to save.”

Written By Neil Downing

Have questions? Need help? Call the CAPTRUST Advice Desk at 800.967.9948, or schedule an appointment with a retirement counselor today.